A Secret Weapon For Social Security login

A Secret Weapon For Social Security login

Blog Article

Safeguard your private facts. Be cautious of any Get hold of professing being from the federal government agency or regulation enforcement telling you about a problem you don’t realize, even when the caller has several of your own information.

In 2009, the Business office of your Main Actuary from the SSA calculated an unfunded obligation of $15.one trillion to the Social Security method. The unfunded obligation would be the difference between the future expense of the Social Security method (based upon many demographic assumptions such as mortality, workforce participation, immigration, and age expectancy) and full assets within the Belief Fund specified the expected contribution level by The existing scheduled payroll tax.

You may be able to post one particular doc to serve as evidence of your identify change and identity. As an example, you might post a marriage certificate as evidence of name improve and identity When the certificate exhibits the wedding transpired throughout the prior two decades and:

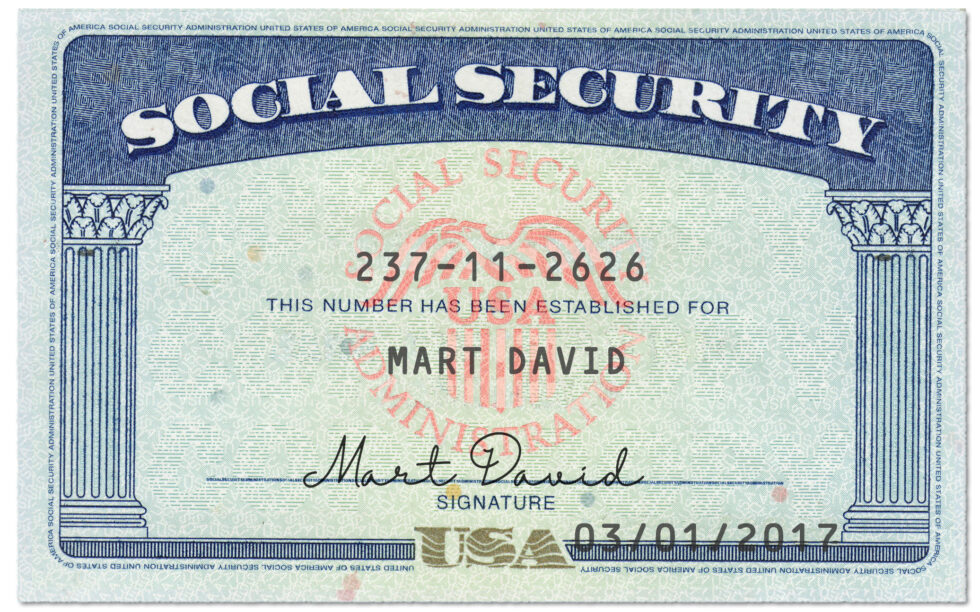

Employing a social security number generator to generate a fake or random social security range would not present any complete privacy security.

For those who have non permanent authorization to live and do the job in The us, you can find a Social Security card stamped “valid for operate only with DHS authorization."

One more function, a immediate deposit fraud prevention block, stops anybody from enrolling in immediate deposit, or shifting your handle or direct deposit information and facts by means of your on-line account or possibly a financial establishment. You will need to Get in touch with a local Workplace to make any variations or to get rid of the block.

You are now leaving AARP.org and gonna a web site that isn't operated by AARP. A special privacy coverage and phrases of company will utilize.

When The prices on the Social Security plan began to exceed profits in 2018, the have confidence in fund started to vacant and, devoid of variations manufactured on the process, is going to be completely depleted Down the road. In a very study of 210 members of your American Economics Association revealed in November 2006, eighty five p.c agreed While using the assertion: "The gap among Social Security money and expenditures will turn into unsustainably large inside the subsequent fifty several years if latest insurance policies remain unchanged."[113]

Proposals to reform of your Social Security procedure have triggered heated discussion, centering on funding of the program. Specifically, proposals to privatize funding have brought on terrific controversy.

Supplemental Security Income (SSI) makes use of exactly the same disability criteria because the insured social security disability program, but SSI is just not centered on here insurance policy protection.

The figure is intended For example the size on the deficit. Laws could close the deficit in strategies other than increasing the payroll tax charge.

Positive aspects are funded by taxes imposed on wages of workers and self-utilized folks. As discussed below, in the case of work, the employer and worker are Every single answerable for one particular fifty percent from the Social Security tax related to the worker, with the employee's half staying withheld from the employee's spend check.

The retirement outcome occurs whenever a taxpayer saves a lot more on a yearly basis in an effort to decrease the full amount of years he should function to accumulate enough price savings just before retirement. The bequest influence occurs any time a taxpayer acknowledges a lower in sources stemming through the Social Security tax and compensates by growing personalized savings to cover future anticipated fees of having youngsters.[213]

Critics have drawn parallels in between Social Security and Ponzi strategies,[177][178] arguing that the sustenance of Social Security is because of constant contributions with time. 1 difference between a standard Ponzi scheme and Social Security, is usually that even though equally website could have comparable structures—especially, a sustainability challenge when the number of new men and women shelling out in is declining—they've got differing degrees of transparency. In the situation of a traditional Ponzi scheme, The actual fact that there's no return-creating mechanism aside from contributions from new entrants is obscured[179] whereas the Social Security scheme is designed to have payouts openly underwritten by incoming tax revenue along with the desire around the Treasury bonds held by or for that Social Security plan.